Key takeaways

Original Medicare is a federal health insurance program for Americans 65 or older and for those under 65 with specific health conditions, offering coverage through Parts A and B for hospital and medical services.

Medicare Part A covers hospital care and is premium-free for those who’ve worked 40 quarters (10 years), with varying costs for hospital stays and skilled nursing facility care; Part B covers outpatient care with a monthly premium and additional costs like deductibles and coinsurance.

Medicare Advantage (Part C) offers an alternative to Original Medicare with added benefits like prescription drug coverage, but has limitations such as network restrictions, while Original Medicare allows any provider that accepts Medicare.

There are programs to help save on Medicare-related costs for low-income beneficiaries, including the Low-Income Subsidy Program, Medicare Savings Programs, and discount cards for prescription drugs.

Original Medicare is federal health insurance for Americans who are 65 years old or older. You may be able to receive Medicare benefits before you turn 65 if you have Lou Gehrig’s disease or End-Stage-Renal Disease or if you have received Social Security Disability Insurance (SSDI) benefits for more than 24 months.

There are four parts of Medicare:

- Medicare Part A is hospital insurance.

- Medicare Part B covers outpatient care and medical services.

- Medicare Part C is an alternative way to receive your Medicare benefits through private insurance plans.

- Medicare Part D is coverage for prescription drugs.

Original Medicare includes Parts A and B. Part D is an optional stand-alone prescription plan for people with Original Medicare.

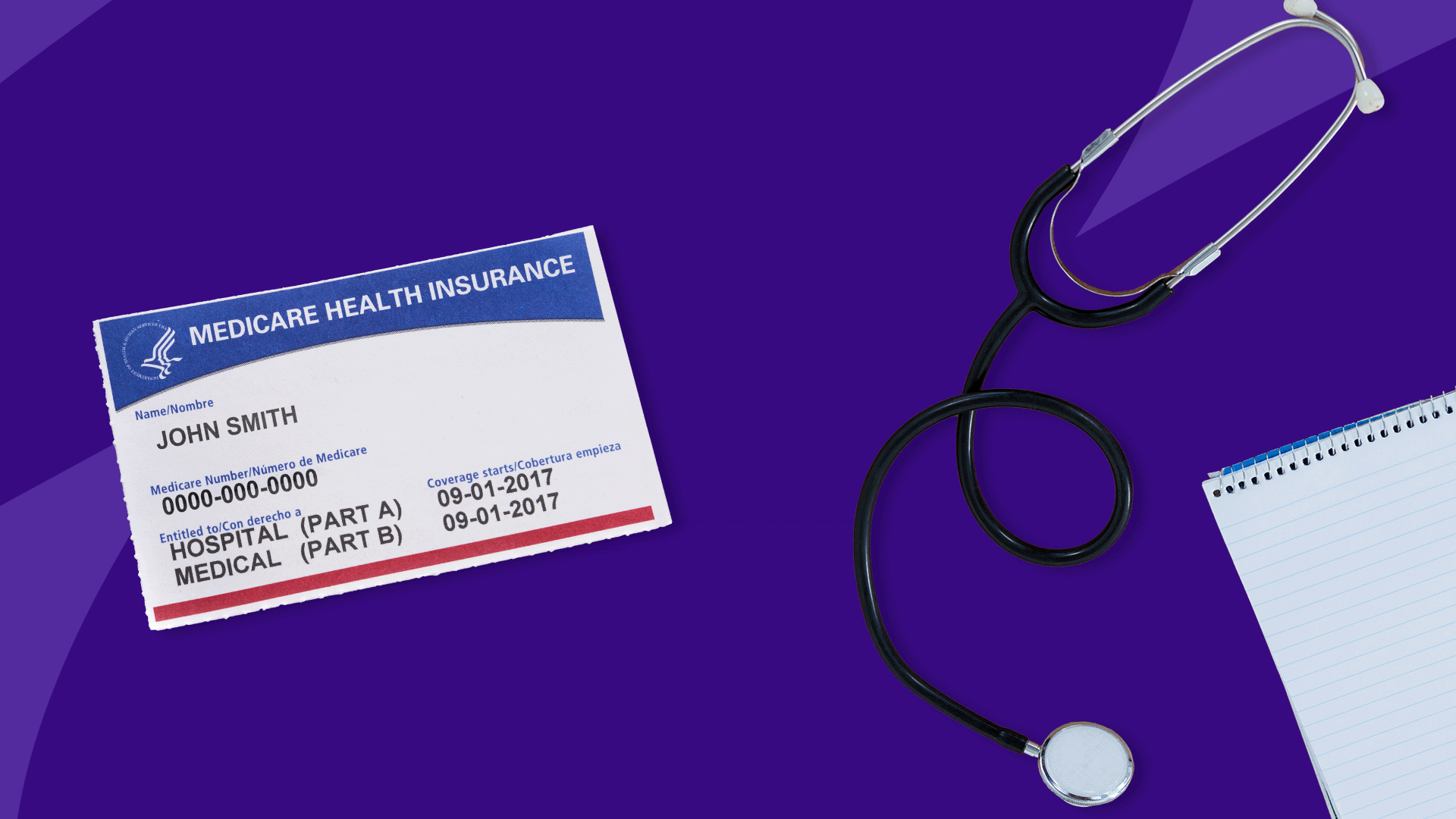

To find out if you have both parts of Original Medicare, you can review your red, white, and blue Medicare card, check online at either medicare.gov or ssa.gov, or call Medicare or The Social Security Administration. If you are enrolled in Medicare Part C or Part D, you will receive separate insurance cards for those programs.

Part A

Medicare Part A covers services that include the following:

- Inpatient hospital care

- Inpatient care in a skilled nursing facility that’s not custodial or long-term care

- Hospice care

- Home health care

Part B

Medicare Part B covers the following:

- Doctor visits

- Preventive services

- Outpatient services

- Diagnostic laboratory tests

- Durable medical equipment

- Drugs administered in the physician’s office

- Outpatient surgeries

- Outpatient imaging tests: X-rays, MRIs, CT scans, ultrasounds, etc.

Part D

Medicare Part D covers the following:

Medicare Part D is optional prescription drug coverage for people with Original Medicare. However, if you enroll in Original Medicare without Part D and you do not have creditable drug coverage, you will pay a late enrollment penalty if you add a Part D plan after your Initial Enrollment Period.

What is not covered

For healthcare services and procedures to be covered by Original Medicare, they must be considered medically necessary. In addition to being medically necessary, the procedures must be approved by the FDA. Some items that Original Medicare doesn’t cover will include:

- Routine dental coverage

- Vision coverage

- Hearing aids

- Cosmetic surgery

- Prescription drug coverage

How much does Original Medicare cost?

In 2025, Original Medicare will cost $185 or more per month. The cost of Original Medicare depends on how long you or your spouse worked (Part A), your reported income from two years ago (Part B), and whether you have a Part D plan. In addition to a monthly premium, you’ll owe a deductible before each part of Medicare begins to cost-share and a copay/coinsurance for covered medical services. See the breakdown of costs below.

Part A costs

Medicare Part A is premium-free for most beneficiaries. As long as you or a spouse worked at least 40 quarters (10 years) throughout your lifetime, you’ll receive Medicare Part A at no monthly cost.

If you worked less than 40 quarters, you might still be able to receive Medicare Part A, but you’ll pay a monthly premium of of $285–$518 per month, depending on your work history.

Your premium will depend on how long you or a spouse worked and paid into Medicare taxes.

You also have other costs associated with Medicare Part A. Here are the Part A costs for 2025:

Hospital stay:

- $1,676 deductible for each benefit period

- $0 for the first 60 days of inpatient hospital care per benefit period

- $419 per day for days 61–90 of inpatient hospital care per benefit period

- $838 per lifetime reserve day.

- After day 90 of inpatient care per benefit period (Medicare enrollees have a maximum of 60 reserve days in their lifetime)

Skilled nursing facility (SNF) stay:

- $0 for the first 20 days of inpatient SNF care per benefit period

- $209.50 per day for days 21-100 of inpatient SNF care per benefit period

- All costs for each day after day 100 of inpatient SNF care in the benefit period

A benefit period measures your use of a hospital or SNF. A benefit period begins the first day that you are admitted to a hospital or SNF and ends when you have not received inpatient care for 60 days in a row. The costs above may vary if you have a Medigap plan, Medicare Savings Program, or Medicaid.

Part B costs

The monthly premium for Medicare Part B in 2025 for most beneficiaries is $185. The monthly premium may be higher depending on your reported income from two years prior.

In addition to the premium, there are additional costs when using Medicare Part B.

- $257 annual Medicare Part B deductible

- 20% coinsurance if your healthcare provider accepts Medicare assignment

- 15% excess charges above Medicare’s approved amount if your healthcare provider does not accept Medicare assignment

Once you meet the Medicare Part B deductible, Medicare will pay 80% of the Medicare-approved amount, leaving you with 20% coinsurance.

Some healthcare providers don’t accept Medicare assignments in these cases and can charge you an additional 15% above the Medicare-approved amount.

Medicare beneficiaries may enroll in Medicare supplemental insurance (Medigap) to help cover the out-of-pocket cost-sharing associated with Original Medicare.

Part D costs

The monthly premium for Medicare Part D varies by plan, but the national benchmark premium for 2025 is $36.78 per month. There are various coverage stages that may affect your cost for covered prescriptions throughout the year:

- The Part D deductible ranges from $0 to $590, depending on the plan.

- After you meet the plan’s deductible, you’ll be responsible for paying a copay or coinsurance (also determined by your specific plan).

- After you and the insurance company have spent a combined amount of $2,000, you’ll pay 0% of drug costs. This is new for 2025.

Original Medicare vs. Medicare Advantage

Medicare Advantage plans (Medicare Part C) are an alternative way to receive your Medicare benefits.

These private health insurance plans must cover the same benefits as Original Medicare, and the coverage must be as good or better than Original Medicare.

These plans are regulated by the Centers for Medicare & Medicaid Services but are administered by private insurance companies.

Coverage:

Medicare Advantage plans frequently include prescription drug coverage and possibly some extra benefits not covered by Original Medicare.

Medicare Advantage plans will differ depending on where you live and which insurance company you choose.

Cost:

The costs associated with a Medicare Advantage plan can vary as well. There is typically a low monthly premium and, in some cases, a $0 premium. There will be fixed, predictable copays for most services. An additional benefit is that Part C plans have a limit on out-of-pocket costs, unlike Original Medicare.

Limitations:

There are also some drawbacks to Medicare Advantage, such as potential denial of care, a limited network of healthcare providers, a prior approval requisite for services, and Original Medicare no longer administering your healthcare benefits.

If you are unsure about which program may best meet your needs, call 1800-MEDICARE or seek out a state health insurance assistance program, area agency, or nonprofit that specializes in Medicare.

RELATED: How to choose between Original Medicare vs. Medicare Advantage

How to save money on Original Medicare-related costs

Medicare may still be expensive, and there are many programs that can help with cost-sharing.

- For those beneficiaries with low income, you can look into the Low-income Subsidy Program or Extra Help. This program assists with the costs of prescription drug plan premiums, deductibles, copays, and coinsurance.

- A Medicare Savings Program can also assist low-income Medicare beneficiaries with help paying for their Original Medicare premiums, deductibles, copays, and coinsurance for medical services.

- Other ways to save on prescription drug costs (whether you have Part D or not) include discount cards like SingleCare. SingleCare has no fees and provides a discount of up to 80% on prescriptions. However, you’ll have to use SingleCare instead of Medicare. Prescriptions purchased with a SingleCare discount card will not apply to your Part D deductible.

- Welcome to Medicare, medicare.gov

- The United States Social Security Administration, ssa.gov

- Contact Medicare, medicare.gov