Key takeaways

One in four people taking prescription drugs finds it difficult to afford their medications, with those spending $100 or more per month or in fair/poor health most affected.

Brand-name drugs without generic alternatives, such as insulin and Humira, are notably expensive, with some treatments costing thousands of dollars per month.

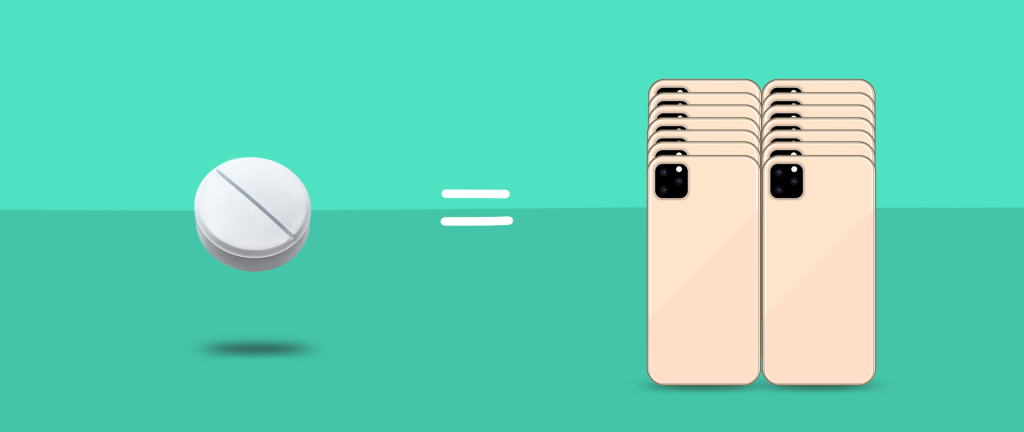

The high cost of certain prescription drugs can equate to the price of luxury items, such as multiple iPhones, high-definition TVs, or a new washer and dryer set.

Patients have options to save on prescriptions through talking to their doctor for alternatives, using pharmacy discount cards, or seeking help from assistance programs and pharmaceutical assistance programs offered by drug manufacturers.

Many people struggle to afford their medications.

“As a pharmacist, this is something I encounter almost daily,” says Kristi Torres, Pharm.D., pharmacist-in-charge with The Austin Diagnostic Clinic Pharmacy and a member of the SingleCare Medical Review Board. “There is typically a look of dismay in the patient’s face followed by a statement such as ‘How much did you say?’ or ‘I just can’t do that.’”

One in four people who are taking prescription drugs say that it’s hard for them to pay for those medications, according to poll results from the Kaiser Family Foundation (KFF). The people most likely to say they’re having trouble affording their medications are people spending $100 or more per month on prescriptions, followed closely by people in fair or poor health.

Brand-name drugs with no generic alternative are often pricey, notes Dr. Torres. This often includes insulin and other injectable diabetes treatments, among others.

The most expensive drugs

Your eyes may widen at the cost of some of the priciest prescription drugs on the market right now, according to SingleCare’s prescription data. Some new drugs have price tags in the five figures. Even medications that are much less expensive than the top-of-the-list drugs can be costly if your health insurance doesn’t cover the price—or if you don’t have insurance.

Take Humira. Many people depend on it to help them manage pain from a variety of health conditions. Humira is an immunosuppressive drug often prescribed to treat conditions like rheumatoid arthritis and ankylosing spondylitis, as well as ulcerative colitis and Crohn’s disease. It falls into a category of medications known as tumor necrosis factor (TNF) blockers because it blocks the action of tumor necrosis factor, a substance produced in your body that can cause pain and inflammation.

And it’s not cheap. One type of the injectable form of Humira will set you back $9,829 for a month’s supply. No, that’s not a typo. For the same price, you could buy two ultra-high-definition televisions that would take up half of a wall in your living room. Or you could buy 14 of the latest model of iPhone. Other versions of injectable Humira cost as much as $8,817 (12 iPhones) and $7,037 (10 iPhones) for 30 days.

If a doctor prescribes Rexulti for you or a family member, you will be looking at a bill as high as $2,700 for a 30-day supply of 0.5 mg tablets of this antidepressant. You could replace your aging washer and dryer set with a brand new, high tech pair for about the same cost. Consider a new front-loading 14-cycle LG washing machine for $1,170 and an LG electric steam dryer for $1,620.

Prolia treats osteoporosis in postmenopausal women, but it can be useful for anyone at a high risk for bone fractures. The approximately $1,400 price tag may be a stumbling block for some people. That’s about the same cost as a daily venti caffé latte from Starbucks for an entire year, or the cost of a pair of five-day cruise tickets in the Caribbean.

Viberzi, a medication used to treat irritable bowel syndrome, can cost around $1,176 for a 30-day supply of 100 mg tablets. That’s about the same cost as a slim, shiny new Microsoft Surface 3 laptop computer. Or you could buy three members of your household each their own set of mid-priced Beats by Dre headphones.

How to save on prescriptions

Fortunately, you have a few options. Talk to your doctor if your health insurance does not cover the cost of your drugs. He or she may be able to prescribe a generic or lower-cost alternative.

“I have had patients stop medications or call and request different medications,” says Nikki Hill, MD, a dermatologist with SOCAH Center in Atlanta, Georgia. “It’s tough if there aren’t alternatives. We have to be mindful of what is considered expensive to patients.”

You can also talk to your pharmacist, who may be able to explain how your insurance deductible affects the cost or help you find assistance programs that could offset some of the cost. “My main goal [as a pharmacist] is to let patients know I am here to help them,” Dr. Torres says.

Some of those programs that could help cover medication costs include pharmaceutical assistance programs offered by drug manufacturers, state-sponsored pharmaceutical assistance programs, and charitable programs such as the National Patient Advocate Foundation.

“Many pharmacies offer cash discount plans for the uninsured, and there are also many options for pharmacy discount cards, which take a percentage off of the retail drug price,” added Dr. Torres.

One of those options is the SingleCare savings card. You can check the price of your prescription from home; or you can ask the pharmacist to look up the price difference. You can use the card whether you have insurance (including Medicare Part D) or are uninsured. However, SingleCare can’t be used in conjunction with your insurance or Medicare Part D—you can only use one or the other. In many cases, we can beat the cash price—or even your copay price.

Always make sure to compare your options to get the best savings possible—so you can afford that flatscreen TV or new iPhone …. along with your medications.

*Prices based on data from December 2019. Prescription prices vary by pharmacy location, and may change.